CXFS 2025

TBA

Whitepaper & Video Center

Conversational Outreach: It’s Not What You Say, It’s How You Say It

In a world where it’s easier than ever to send a message, but harder than ever to get a response, how do you break through that noise and make a connection? This white paper provides valuable insights from Drips on how to leverage an AI-Powered Conversational Outreach strategy for your organization.

CXFS 2022 Innovation Briefing Report 1

In this CXFS Innovation Briefing, we discuss the transformation that customer experience in the financial industry going through, how it is being optimized, and how you can implement the same strategies in your company, too!

CXFS 2022 Innovation Briefing Report 2

Whether you’re coming from a big bank, mid-sized credit union, fintech, wealth management firm or insurance company – you’re all fighting the same uphill battle and have the same end goals: keep your clients satisfied, win new business amidst up-and-coming competition, and promote the importance of a strong CX strategy. In this CXFS Innovation Briefing, we discuss the transformation that customer experience in the financial industry going through, how it is being optimized, and how you can implement the same strategies in your company, too!

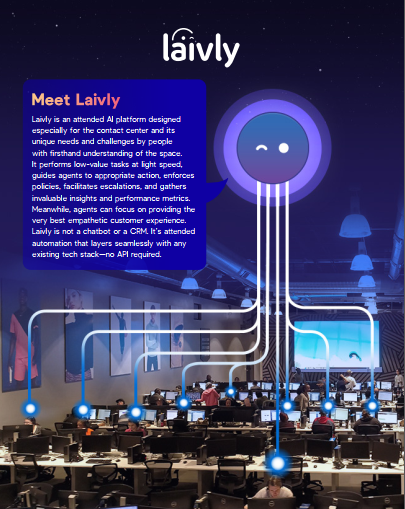

Meet Laivly

Meet Laivly, an attended AI platform designed specifically for contact centers. We equip friendly humans with intelligent automations to create the best customer experiences on the planet. This brochure gives you an overview of what we do, how we do it, and what you can expect us to do for you.

Digital Experience Optimization (delivered by BlastX)

Digital experience optimization (DXO) is constantly knowing your customers and providing the best experience across their customer journey. One step further, DXO differentiates your brand, creates customer loyalty, and leads to bottom-line results.

The CX Leaders Intelligent Guide To Growth

How customer-centric leaders can make Unified Customer Intelligence their growth engine.

Acquisition, Engagement, and Loyalty in the Financial Sector: How Financial Institutions Can Build Pathways to Lifetime Customer Value

“Consumers are growing increasingly alienated by legacy banking models that have failed to embrace digital transformation and integrate more modern, frictionless, and mobile-native experiences,” Forbes describes. But digital also offers more opportunities to build holistic relationships with customers—from the point of acquisition and through those customers’ lifelong relationships with FIs. This special WBR Insights research report explores how FIs can successfully manage the customer experience to generate continuing value for the business. It also analyzes emerging opportunities for FIs looking to implement a next-generation digital strategy.

The Banking Industry Today: Catching Up with Transforming Customer Expectations

The impact of technology—on the industry, and on customers—provides both the biggest challenges, and the greatest opportunities. Today’s consumers expect the information and services they want, whenever they want it, on the platforms of their choosing. It’s a huge demand. The ability to offer what customers and prospects expect will be key to survival.

Email 101 for Financial Services: 15 Proven Tactics to Boost Deliverability and Engagement

According to a 2018 study by Litmus1, the ROI of email marketing is $38 for every dollar invested. Another 2018 study by the Relevancy Group2 found email to be the top channel used by financial services companies to communicate with customers and prospects. And U.S. marketing executives who participated in the study believe that email by itself drives the same amount of revenue as social media, Web, and display ads combined. So it’s clear that, if done correctly, high-volume email operations can deliver tremendous return on investment. But email only works if it actually reaches your customers. Most businesses achieve a deliverability rate of 80%, according to a 2017 study by Return Path.3 So 20% of emails never reach their intended inbox, which is unacceptable and results in billions of dollars in lost revenue each year.Whether your focus is email marketing, onboarding and user engagement, retention or customer service, every undelivered message is a missed opportunity — and a hit to your bottom line. Don’t let mediocre deliverability rates erode the value of your email operations. The best practices discussed in this e-book will help you ensure the best possible inbox rates — and the best ROI for your financial services business.

Are Customer Communications Getting SMARTer?

Customer demands are at an all-time high and still growing. Delivering an exceptional customer experience throughout the entire lifecycle is key to a company’s success. And customer communications play a critical role in the overall customer experience. Every communication sent is part of a larger, ongoing conversation with the customer. However, every business reaches a point where that conversation becomes more complicated due to increases in channels, touchpoints, interactions, and disruptions.

Hyper Personalization Drives Engagement and Deepens TD’s Relationships with its Customers.

TD Bank Group, a top ten bank in North America by branches, partnered with Flybits in 2016 to leverage the fintech company's proprietary context-as-a-service platform. TD selected Flybits to help generate personalized, meaningful, and valuable interactions with its Canadian customers beyond the branch. Only one year after launch, 1.2 million users have embraced Flybits’ innovative technology. Adoption continues to increase as TD successfully employs Flybits' data intelligence and contextualization capabilities to drive digital engagement, presenting customized information to registered users at the moment they would find the communication most helpful.

CXFS 2019 Innovation Briefing

As we head further into 2019, the financial services industry continues to face massive changes. Branches are closing, fintechs are disrupting, and customers expectations have never been higher. This creates a unique challenge for experience executives working to streamline the customer journey for financial products. By their nature, financial services companies are revenue driven, compliance laden and legacy based. CX leaders have a hard time getting c-suite approval for their strategies, a hard time getting budget approval for those strategies, and then the strategy is subjected to rounds of compliance verification. If that weren’t enough, strategies that move past this point need to somehow fit into the bank’s pre-existing core infrastructure or be built on top of it. This lengthy and overburdened process makes it very hard to streamline the customer experience and even harder to innovate for the customers delight.For these reasons, the industry needs CXFS, an annual event for CX and marketing leaders in financial services. Financial services companies want to see how their peers in the industry have managed to make their customer a top priority at their respective companies, received budget approval for CX initiatives past basic surveys, worked around compliance constraints, and built CX into their current company hierarchy. This reports aims at uncovering how companies are rethinking their cx strategy using the latest innovations in technology to solve the problems of today’s banking customers and meet the expectations of the tech-savvy consumer.

5 Priorities for Providing a Successful Customer Experience by InMoment

Financial services clients are changing in many ways, and they want a company that will evolve with them. Clients are increasingly using technology to perform actions that were previously reserved for human interactions. Additionally, as a younger generation steps in, financial services institutions must adjust to an entirely new type of customer—one that favors conve-nient, personalized, and secure digital experiences. Download the eBook by InMoment to find out more!

Want even more reading material? View whitepapers and reports from our 2019 event.

2019 Media Center